|

|

此文章由 铁板烧 原创或转贴,不代表本站立场和观点,版权归 oursteps.com.au 和作者 铁板烧 所有!转贴必须注明作者、出处和本声明,并保持内容完整

本帖最后由 铁板烧 于 2018-8-30 16:09 编辑

从9月1号开始,CBA将改变计算利息和redraw金额的方法。如果你有额外还款,CBA将按剩余的贷款年限扣除,允许再提取的金额将少于当初额外还款的金额。对冲帐户则不受影响。

How it works

The rate at which your redraw balance will reduce is dependant on a number of factors and is different for every customer.

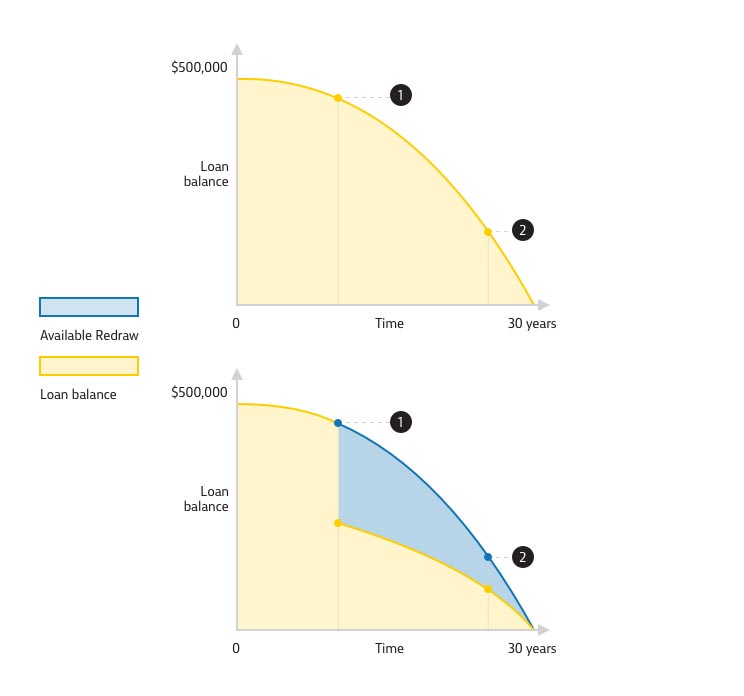

Cara takes out a $500,000 variable rate home loan with a loan term of 30 years. She makes principal and interest repayments on her loan. The graph shows how her home loan balance will decrease over time.

In year 10 her loan balance is $408,000

In year 25 her loan balance is $142,000

Let’s say Cara makes a $200,000 additional repayment toward her loan in year 10, and continues to pay the minimum repayment to pay off her loan in 30 years. Her minimum principal and interest repayment will reduce.

In year 10 her loan balance will be $208,000, while her available redraw balance will be $200,000. This adds up to what her loan balance would have been if she had made no additional repayment ($408,000)

In year 25 her loan balance would be $72,000, while her available redraw balance is $70,000. This adds up to what her loan balance would have been if she had made no additional repayment ($142,000). Other factors may affect your available redraw.

https://www.smh.com.au/money/bor ... 0180817-p4zy2c.html

https://www.smh.com.au/money/pla ... 0180823-p4zzcv.html

https://www.commbank.com.au/bank ... ource=inartcilelink |

评分

-

查看全部评分

|

参加活动-值得一去再去的天之涯,海之角 -新西兰南岛 (2011-4-18) 老猫晒太阳

参加活动-值得一去再去的天之涯,海之角 -新西兰南岛 (2011-4-18) 老猫晒太阳  宝宝趣事 - Jeff回家啦! (2007-9-25) daffodil

宝宝趣事 - Jeff回家啦! (2007-9-25) daffodil  西边雨看生意记(连载)-第4页更新 (2005-3-31) 西边雨

西边雨看生意记(连载)-第4页更新 (2005-3-31) 西边雨  ¤¤¤¤¤ 我亲爱的小叔 ¤¤¤¤ (2015-8-1) sophiebeibei

¤¤¤¤¤ 我亲爱的小叔 ¤¤¤¤ (2015-8-1) sophiebeibei