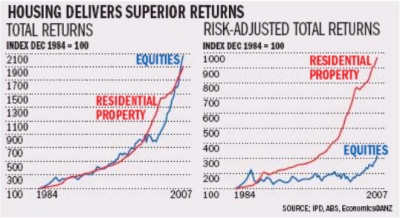

Safe as houses: returns on inner-city residential property in 2008 are expected to exceed those from the broader equities market. 据1月12日《The Age》报道,长期而言,与其它投资工具相比,在澳洲投资房地产的回报是低风险高回报的。 最新出炉的澳新银行2008年地产市场展望(The ANZ property market outlook for 2008)阐述论证了这一观点。 一家之言,仅供参考。 House prices to keep going through the roof January 12, 2008 ONE man's housing affordability crisis is another man's lucrative investment market. Escalating house prices show little sign of abating and long-term figures confirm Australian residential property is a strong, stable investment — sexy qualities in these shaky times. The ANZ property market outlook for 2008 was unequivocal in its recent forecast: "A severe and potentially intractable shortage of housing will continue to drive house prices and rents sharply higher in the years ahead." This was despite Bureau of Statistics data on Tuesday showing total building approvals rose 8.9% — on a seasonally adjusted basis — and were up 14.6% last year. The Australian Property Council welcomed the figures, but said underlying demand was still outweighing supply. Head of financial analysis at ANZ, Paul Braddick, agreed: "It's probably likely to be very short-lived … Supply remains constrained and demand is still incredibly strong, bolstered by high net migration." ANZ analysis shows residential property has had remarkable returns over the past 23 years. Since 1984, residential property delivered a compound annual total return of 13.4%, only slightly below equities (13.8%) and well above commercial property (10.3%) and bonds (9.4%). But once volatility was added to the equation, residential property returns more than tripled those of equities and more than doubled those of commercial property and government bonds. In stark contrast to the shaky sharemarket, ANZ reported that house prices had "virtually never fallen", apart from a 0.3% drop during the recession in the early 1990s, and a 0.9% drop in 1996. Mr Braddick said growth continued to defy those waiting for the "bubble to burst", and expected residential property to outgrow equities in 2008. He also predicted the gap between prices in inner-city and outer suburbs would narrow. But Alliance Finance Group director Craig Dres said he believed sections of the market would decline. "I suspect there will be a fallout, and those glued to the set will find some discounted prices. It's inevitable. The highs can't continue forever, and the cycle will turn, although I think inner suburbia is still solid." Mr Dres said the market was yet to see the impact of November's interest rate rise, and that the outer suburbs would soon start to feel the pinch. Renters are also likely to suffer from the rate rise and escalating house values. Australians For Affordable Housing chairman Michael Perusco said he hoped some of the money flooding into residential property would be channelled by affordable housing schemes and new tax offsets offered by the Government's National Rental Affordability Scheme. |