|

|

此文章由 zzb83105 原创或转贴,不代表本站立场和观点,版权归 oursteps.com.au 和作者 zzb83105 所有!转贴必须注明作者、出处和本声明,并保持内容完整

本帖最后由 zzb83105 于 2020-12-10 20:11 编辑

Rents to skyrocket in 2021 due to massive undersupply of housing

Propertyology Head of Research Simon Pressley said their claim was in contrast to the majority who thought little to no overseas migration would cause a downturn in the Australian property market.

"The reality is that Australia does not have enough housing supply for its existing 25.6 million population," Mr Pressley said.

"Propertyology is predicting that these next couple of years will produce the biggest increase in rents that Australia has seen in living memory.

"To secure a standard rental property over the next couple of years, it will not be uncommon for households to need to find an extra $2,000 to $5,000 per annum."

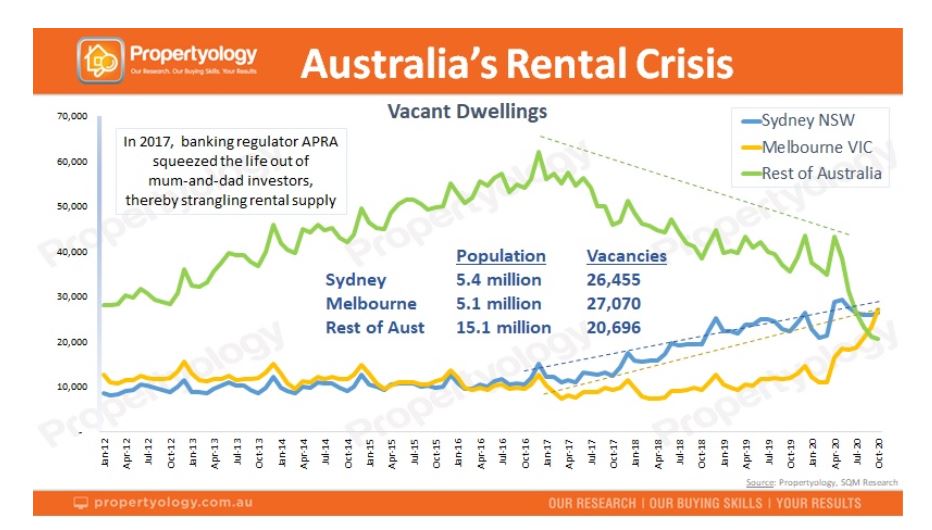

Sydney and Melbourne are a stark contrast to the rest of Australia, currently sporting a surplus of rental stock and falling rents.

Propertyology found as at the end of October 2020, there was a combined 53,525 dwellings advertised for rent for Sydney and Melbourne’s combined population of 10.5 million people.

The remaining 15.1 million are competing for just 20,696 dwellings in the other six capitals and increasingly popular regional locations.

"Propertyology’s buyer’s agents have seen firsthand proof of multi-offer tenant applications and the successful tenant paying $50 to $70 per week above the market’s median rent. It’s a frenzy."

He added the rock-bottom vacancy rates weren't confined to the capital cities.

"From Maitland NSW, to Margaret River WA, Mount Gambier SA, Mackay QLD, and Mildura VIC, Propertyology is tracking an additional 50 individual towns across Australia with vacancy rates below 1%," he said.

"It is the tightest rental conditions that Australia has ever seen. Anyone who forecast a downturn clearly has no clue what ‘housing demand’ truly means." |

|

私立肿瘤医生的日常之小说版 (2019-5-26) ThePlaceToBe

私立肿瘤医生的日常之小说版 (2019-5-26) ThePlaceToBe  烤鳗鱼 (2005-3-4) susan

烤鳗鱼 (2005-3-4) susan  牛肉的分类图示(中英文) (2008-7-16) patrickzhu

牛肉的分类图示(中英文) (2008-7-16) patrickzhu  主妇的HPT体验 (2008-7-24) hero妈

主妇的HPT体验 (2008-7-24) hero妈